QuickBooks is a very useful accounting software for business owners and companies that help in managing the business tasks like financial transactions, tax, banking issues, making invoices, payment, reports, and other tasks of the business. Small businesses find the software to be highly beneficial to maintain the accounting work. It can also benefit the medium-sized businesses. However, the professionals who use QuickBooks have to face some problems while working with the software. Error codes are displayed on it due to the problems in the functioning of the software. These errors can be due to many reasons and it is important to resolve them. The QuickBooks errors code for each problem is different and the issues are categorized according to their error codes.

When a user tries to install the software and if there is any problem in it, it shows the Installation Error. The problem occurs when a user does not install the software fully and it remains incomplete. An error can be displayed if the installation is not done in the right way. This type of error can occur during installation with a CD. It can also occur when a user tries to download the software on the internet. Sometimes, the cause of the error is not known and the display shows an Unknown Error. Update errors are also common in QuickBooks. Some users face the problem of overflow error warning while using the accounting software. Errors occur when some files in QuickBooks are damaged or missing.

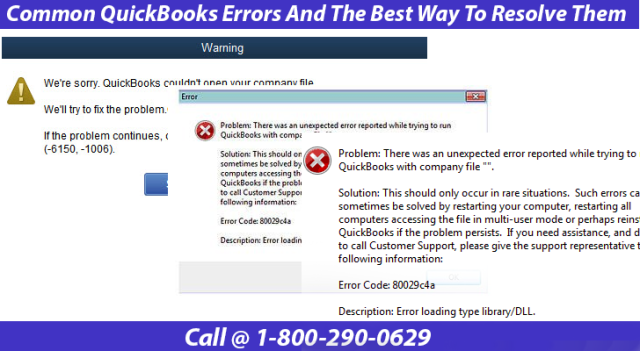

If there is an unexpected error that cannot be rectified, the display shows the sign of Unrecoverable Error. Errors occur when a user accesses the company files and tries to make a backup for it. Problems occur when company files are used that are stored on a different computer and external media. You can have problems if you store the files along with the encryption software in the same location. If the file is used by a different computer or person, it shows an error.

The above problems can occur while using QuickBooks. Due to this, some error codes are displayed on the screen. The users can know the type of problem in the software just by the number of the error code. QuickBooks provides all types of help to the users for resolving these problems. For this, they have to contact the QuickBooks Technical Support. The Support has experts who solve the problems and they help the users in all possible ways.

The technical support for resolving the errors is available in all days of the week at all times as it gives you a 24/7 support. Thus, the users who face problems can contact the support whenever they want without any restriction of time and place. The support for errors is available on the phone and users can talk to an expert personally and get their concerns solved. The QuickBooks Technical Support Number is 1-800-290-0629. You can call on this number if you get error codes while using QuickBooks. Users can also get help for the errors through remote desktop support. This support feature is also useful as it helps in solving problems in the codes by certified Pro Advisors.